Table of Contents

ToggleCosts Beyond Tuition Fees in Higher Education

Welcome to the rollercoaster ride of higher education! You have the confidence to tackle your experiences and conquer the world. But wait. Did anyone mention college’s wildly variable costs beyond Tuition? Buckle up because we’re about to take a fascinating plunge into unforeseen costs that will make you anxious faster than a pop quiz on Monday morning.

Higher education has long been correlated with personal growth, career advancement, and intellectual happiness. However, the financial costs of getting a college or university degree go far beyond tuition fees. In this in-depth blog, we will look at the other costs that students pay in addition to tuition fees, the issues they confront, and the various options available to help them overcome these obstacles. Students and their families can make informed decisions and negotiate the problematic landscape of higher education financing if they understand the entire spectrum of expenses and resources.

Beyond Tuition Fee

When seeking higher education, tuition fees are frequently the primary focus. This is the amount colleges mention on their official websites, marketing materials, and financial assistance letters. This amount is what most students and parents use to compare different possibilities. However, many people should be aware that Tuition is merely the tip of the iceberg regarding the costs of a degree. Numerous other fees are sometimes concealed, missed, or underestimated and can add up to a substantial sum throughout your college career. Knowing the exact cost of college is critical for making informed future decisions, avoiding excessive debt, and increasing your return on investment. In this post, we’ll go beneath the surface to uncover the hidden costs of higher education, which frequently surprise students and parents.

- Room and food: The cost can be high for residential college students. Whether you live in a dorm on campus or an off-campus apartment, housing costs can rapidly pile up. It includes rent, utilities, groceries, and other home expenses. It is critical to examine the cost of living in the area surrounding your chosen university and plan accordingly. According to the College Board, On-campus room and board costs at public four-year institutions averaged around $11,620 for in-state students and $12,990 for out-of-state students in the 2020-2021 academic year. Off-campus housing in the United States had an average monthly rent of $800-$900 in 2023.

- Books & Supplies: Textbooks and educational supplies can be unexpectedly expensive. Students are frequently forced to purchase textbooks, access codes, laboratory materials, and other course-specific goods, which can quickly add up to hundreds of dollars per semester. Although some colleges provide rental programs or digital textbooks to help with these fees, they are nevertheless an expense that should be addressed. For instance, according to the College Board, a full-time undergraduate student spends an average of $1,240 or more yearly on books and supplies in the United States. Some STEM (Science, Technology, Engineering, and Mathematics) texts require periodic revisions to keep current, which increases student fees. For example, the 12th edition of Campbell Biology costs $259.99 new, compared to $69.99 for a used 11th edition.

- Transportation: Whether traveling from home or moving to a new place, transport expenditures are significant for many students. It covers automobile fuel, public transportation fares, parking fees, and maintenance costs. Students studying abroad or enrolling in an internship may result in additional travel expenses. Include these items to develop an appropriate budget and avoid financial hardship. However, according to data from the Bureau of Labor Statistics (BLS), the average monthly transportation expenditure for all households in the United States was approximately $800-$900.

- Health care: Medical costs and health insurance are two frequently disregarded components of college spending. Many universities mandate that their students get health insurance from a private company or one sponsored by the institution. Consultation, Prescription drugs, costs, and other medical expenses can mount up fast, particularly for students who have long-term medical issues. Maintaining your physical and financial well-being depends on knowing your alternatives for medical treatment and setting aside money for these expenses. According to data from the U.S. Department of Health and Human Services, the average monthly health insurance premium for an individual in the United States is around $456.

- Personal expenses: The costs associated with living in college, from eating out with friends to entertainment and personal care products, may increase rapidly. Setting aside funds for non-essential expenses is crucial, even while you adhere to your spending plan. You can ensure you have enough money to do the necessities without going over budget by establishing boundaries and prioritizing your expenditures.

- Extracurricular Activities and Fees: Your college experience can be enhanced by joining organizations, sports teams, or other extracurricular activities, but costs may be involved. These extracurricular activities may impact your budget via club dues, equipment purchases, or travel expenditures to conferences or contests. Consider these expenditures when choosing which activities to pursue and making appropriate plans.

- Financial aid repayment: Financial aid packages can assist in covering the expense of a college education, but it’s crucial to remember that loans have repayment obligations. To prevent future financial hardship, it’s critical to comprehend the terms of your loan, including interest rates and repayment plans. Furthermore, obtaining grants, scholarships, and other financial assistance can lessen the need for student loans and lower debt levels after graduation.

A Glance at Rising Tuition Fees

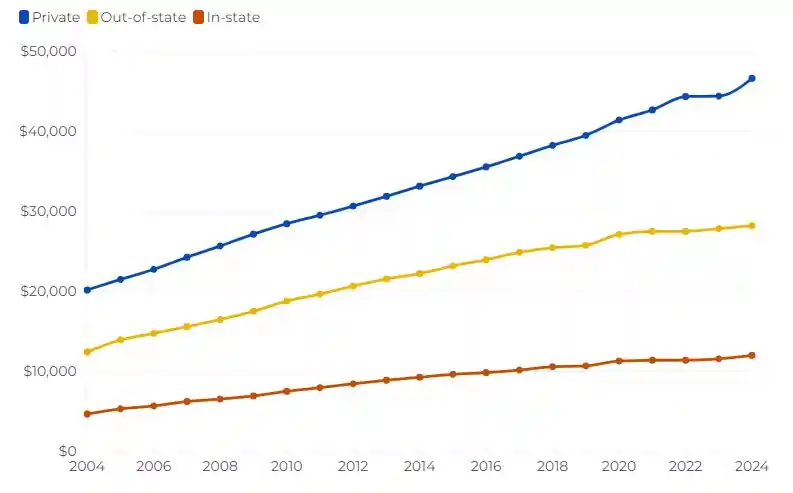

Undergraduate fees are far higher today than they were two decades ago. According to U.S. News data, the average cost of tuition fees at ranked private National Universities/schools has climbed by roughly 40% since 2004, after accounting for inflation. According to U.S. News data, the average Tuition and fees for the 2023-2024 academic year are $42,162 for private institutions, $23,630 for out-of-state students at public universities, and $10,662 for in-state residents at public schools. Furthermore, the average Tuition and fees for attending an in-state public college are over 75% lower than the average sticker price paid by a private institution.

Similar statistics can be fetched from the College Board, which states that the average advertised Tuition and fees for in-state students at public four-year colleges were roughly $10,560. In contrast, students from other states paid an average of $27,020. The average released Tuition and fees for private nonprofit four-year universities were around $38,070 for 2020-2021. The average price at all ranking private colleges grew by nearly 4% between the 2022-2023 academic year and 2023-2024, according to statistics given to U.S. News data by 976 schools in an annual poll. Meanwhile, tuition increases for both in-state and out-of-state students at rated public schools were slightly lower, up 2% and 1.4%, respectively, from the previous year. According to statistics from the College Board’s annual survey, Trends in College Pricing and Student Aid 2022, Tuition and fees at public two-year colleges will average $3,860 for in-state, in-district students in 2022-2023. Furthermore, these estimates do not account for other expenses, including housing and board, textbooks, supplies, transportation, and personal expenses, which can significantly increase the overall cost of attendance.

20-Year Average Tuition Growth Among National Universities, 2004-2024

Source: U.S. News & World Report

Top 3 Factors That Influence Tuition Fee

- Public vs. private colleges: Public institutions are government-funded and typically charge lower tuition costs than private institutions, which rely on tuition revenue and donations. However, public institutions may charge varying tuition rates to in-state and out-of-state students, with the latter paying more.

- Undergraduate vs. graduate programs: Undergraduate programs provide a comprehensive education across four years, whereas graduate programs need specialized study. According to the National Centre for Education Statistics, Graduate tuition prices are usually higher, indicating more research and faculty supervision. In 2018-19, graduate students paid an average of $19,210, while undergraduates paid $13,120.

- Domestic vs. international students: Domestic students are citizens or permanent residents of the country where the institution is located, whereas international students come from another country and must obtain a visa to study there. International students often pay higher tuition fees and incur additional expenses such as travel and health insurance. According to Times Higher Education, in 2019-20, the average tuition fee for international students at the world’s top 200 universities was $26,790, while local students paid $16,980.

Potential Steps to Secure Your College Fund: A Guide to Planning and Saving for Higher Education

Planning early and accumulating money for college is critical for reducing financial burdens and ensuring access to higher education. Here are some strategies on how to efficiently plan and save money for college:

- Start early:

Begin planning and saving for college as soon as possible, preferably throughout high school or earlier. The sooner you begin, the less you will feel the weight of the expenditure. - Set clear goals:

Determine your educational goals and the kind of college experience you want. Consider the sort of institution (public or private), in-state versus out-of-state possibilities, and potential study topics. - Research College Costs:

Look at the cost of enrollment at several schools and universities, including Tuition, fees, housing, meals, textbooks, and other expenditures. Estimate expenses using online tools such as college cost calculators and financial aid websites. - Create a budget:

Create a realistic budget, including your income, expenses, and savings goals. Set aside funds for education savings, living expenses, transportation, and other essentials. Target your expenditure and adjust your budget as needed to stay on target. - Explore Financial Aid Options:

Investigate the financial aid alternatives accessible to you, such as scholarships, grants, work-study programs, and student loans. Fill out the Free Application for Federal Student Help (FAFSA) to see if you are eligible for federal, state, or institutional help. - Open a college savings account:

Consider creating a separate college savings account, such as a 529 plan or a Coverdell Education Savings Account (ESA). These tax-advantaged accounts enable you to save and invest money exclusively for educational purposes. - Reduce expenses:

Look for ways to cut spending and boost your savings rate. Reduce needless costs like dining out, entertainment, and luxury items. Consider purchasing old textbooks, looking for reductions, and utilizing student discounts. - Work part-time:

Consider working part-time in high school or college to supplement your income and contribute to your education funds. Look for flexible career possibilities on or near campus that fit your academic schedule. - Seek additional sources of income:

Consider additional sources of income, such as freelancing, tutoring, babysitting, or selling products online. Use your skills and talents to produce additional income for your college fund. - Apply for Scholarships & Grants:

Research and apply for scholarships and awards from colleges, private organizations, corporations, and community groups. Scholarships and grants are free money that does not require repayment, making them excellent options for paying for your education. - Monitor Your Progress:

Regularly assess your college savings plan and track your progress toward your financial goals. Adjust your strategies as needed, and enjoy your accomplishments along the way.

Following these steps and remaining consistent in your savings efforts, you can adequately plan and save for college.

Remember that every dollar saved gets you closer to realizing your educational goals.

Thus, “Tuition Isn’t Everything!” it is part of “The Other Costs Of Higher Education”. It is only the start. You can focus on what matters—obtaining that degree and chasing your dreams—rather than becoming overwhelmed by the hidden costs of a university education by making sensible financial and planning decisions.

Related Post:

Post-Secondary Education: Exploring Unique Educational Journey

Unlocking Hidden Gems: Non-Extra Costs Beyond Tuition Fee In Higher Education

You have remarked very interesting details!